About Mn48

- Mn48 (Pty) Ltd – Mn48 is a privately owned South African mining company with both Mining and Property Ownership rights to one of the few remaining high-grade and economically mineable manganese deposits, globally.

- The deposit sits in the Kalahari Manganese Fields (‘KMF’) in the Northern Cape of South Africa, supported by established rail and road infrastructure, with access to several ports for export purposes.

- Key shareholders in Mn48 include:

- Traxys Projects LP (Traxys) – 47%1

- Ntsimbintle Holdings (Pty) Ltd (Ntsimbintle) – 23%1

- South African individuals and empowered entities – 30%1

- The robust Mn48 Project was formed following the amalgamation of the resource that lies within the mining rights of Lehating Mining (Pty) Ltd (‘Lehating’) and the [then] Prospecting rights of a subsidiary of Ntsimbintle, Khwara Resources (Pty) Ltd (‘Khwara’).

- The Mn48 shareholders completed an updated and consolidated resource statement in February 2018 (by MSA Group).

- A bankable feasibility study (‘BFS’) of the Mn48 Project was completed in January 2020 and concluded with the recommendation to proceed with the development of the project given its financial robustness and sustainability.

- Subsequently, the shareholders of Mn48 have taken a decision to

explore a sale of 100% of the shares in Mn48, as well as the sale of 100% of the surface rights attached to the Mn48 Project that resides in Lehating Propco (Pty) Ltd (‘Propco’) (collectively, the ‘Proposed Transaction’).

1. Shareholding subject to the conversion of convertible notes held by Traxys and issued by Lehating and Khwara for the funding of the project development.

Why Mn48 Project is an attractive investment opportunity

-

1

High grade 48% manganese ('Mn') deposit, Wessels type ore body.

-

2

Robust asset with a resource of ~20 Mt and a life of mine ('LOM') of 19 years, with options to extend the resource and LOM.

-

3

Advanced stage documentation (package of licenses and permits).

-

4

Unique controlling interest to acquire 100%.

-

5

Favourable project economics.

-

6

Surrounded by developed key infrastructure and operating mines.

-

7

Marketing agreement with Traxysand Ntsimbintle.

“Mn48 neighbors other historic high-grade mines such as Wessels and Nchwaning.”

History of Mn48

-

2015

07 October 15

Lehating granted mining right.

-

2016

02 December 16

Khwara and Lehating conclude the amalgamation agreement to combine mineral resources, forming Mn48.

-

2017

12 May 2017

Khwara lodges application for a mining right and simultaneous cession thereof to Mn48 i.t.o. s11 of the MPRDA, as well as an environmental authorisation with the DMR (final CP for amalgamation).

-

2018

15 February 18

MSA Group1 completes Mineral Resource estimate and Competent Person's Report ('CPR').

-

2020

17 January 20

WorleyParsons2 issues final BFS of Mn48.

Note : Combined mineral resource statement of Mn48 completed by MSA Group (Pty) Ltd, reported total in-situ mineral resource of 20.1 MT.

1. MSA Group is provider of exploration, geology, mineral resource and reserve estimation, mining and environmental consulting services to the mining industry.

2. WorleyParsons is a provider of professional project and asset services in the energy, chemicals and resources sector.

Project Overview

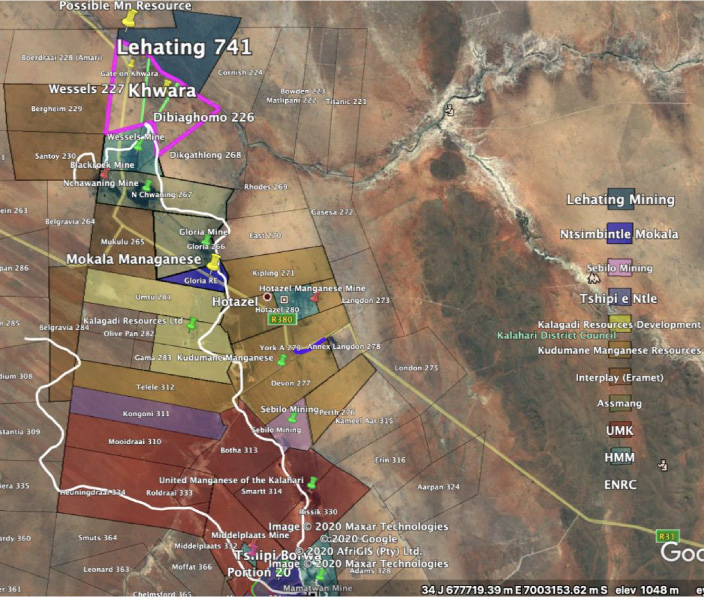

- The Mn48 Project is situated in the KMF near the town of Hotazel, just ~12km from the producing Samancor Manganese owned Wessels mine.

- The 20.1Mt resource at ~48% Mn (in-situ) is JORC code compliant and is considered to be amongst the highest grades in South Africa.

- Engineering studies have designed robust low-cost engineered facilities to continuously produce 960 ktpa of high-grade manganese product, positioning Mn48 favourably on the global manganese cost curve.

- Mine design and processing infrastructure to produce 15.8 Mt of product at ~48% Mn over 19-year project life, with potential to extend LOM by more than five years.

- Mn48’s mining method will be similar to that used at the Wessels mine. It will be a mechanised bord and pillar, with vertical shafts.

- Well developed surrounding infrastructure in the KMF, with road and rail access to Saldanha Bay, Durban, Cape Town and Port Elizabeth / Ngqura ports.

- The underground mine, with a depth of less than 300m, will produce saleable product which can be transported from the mine to ports.

- Mn48 ore is suitable for use in the production of Ferro-Mn (‘FeMn’), Silico-Mn (‘SiMn’) and Electrolytic Manganese Metal (‘EMM’), and High Purity Manganese Sulphate (‘HPMSM’) for lithium battery cathodes.

Shareholding Structure

Mineral Resource3

Category |

Tonnes (mil) |

Density (t/m3) |

Mn % |

MTU |

Fe % |

| Measured | 19.40 | 4.37 | 48.33 | 936.10 | 12.35 |

| Indicated | 0.70 | 4.34 | 49.51 | 36.70 | 12.33 |

| Inferred | – | – | – | – | – |

| Total | 20.10 | 4.37 | 48.38 | 972.90 | 12.35 |

Note : Combined mineral resource statement of Mn48 completed by MSA Group (Pty) Ltd, reported total in-situ mineral resource of 20.1 MT

3. Life of mine of 19 years, excluding expansion potential

Location

Location of Mn48

Mn48 located in the well-developed area of the KMF…

- Established rail and road infrastructure. Transnet rail access available and trucking through high-speed road contracts.

- Similar distance to the various ports: Saldanha (~900km), Port Elizabeth/Ngqura (~1,000km), Cape Town (~1,100km), and Durban (~1,200km).

Key Investment Highlights

-

1

High Grade Ore Body

Reserve at ~48% Direct Shipping Ore ('DSO').

Favourable for traditional and new markets: FeMn, SiMn production, EMM, and

high purity Mn sulphate for lithium ion battery cathodes. -

2

Robust Asset

Resource of ~20m Mt with total saleable reserve of ~15.8m Mt.

Robust project providing 19 years (or more) of a high-grade manganese ore body.

Potential to further substantially increase the resource and extend the LOM. -

3

Advanced Stage Documentation

Approved mining right for the Lehating Farm granting Mn48 to mine Mn and Fe ore.

Approved Mining Right being amended for Khwara Mining Right consolidation,

expected completion in early 2021.

Completed BFS related to Mn48.

-

4

100% Interest Available

Sale of 100% of shareholding in both Mn48 and Propco (surface rights attached to Mn48).

Few projects available in the market where buyer is able to acquire full control including both surface and sub-surface rights. -

5

Favourable Project Economics

Strong steady-state annual production ~1.0m Mt.

Moderate capex requirement (~USD200m).

Sizeable post tax NPV expected (USD360m). -

6

Key Infrastructure

Developed infrastructure in the area with power, paved and unpaved roads and a rail network with access to major ports.

Integrated Water Use License application nearing completion. -

7

Marketing Agreement

Marketing agreement with Traxys and Ntsimbintle, enabling acquisition by strategic as well as financial type investors.

Acquisition of the marketing agreement is also available to prospective purchasers.

“Mn ore is not exchange traded, and prices are largely determined by supply and demand dynamics linked to the global steel industry production levels”

Manganese Fundamentals

- Mn is the 12th-most abundant element in the earth’s crust, and 4th-most used metal after iron ore, aluminium and copper (based on tonnage).

- Global high-grade Mn reserves are mostly situated in the southern hemisphere:

- South Africa, Australia, Brazil, Gabon, and Ghana account for ~68% of total global reserves.

- In 2019, South Africa accounted for ~74% of the world’s identified Mn resources and Ukraine accounts for ~10%.

- More than 90% of the global Mn ore supply comes from South Africa, Australia, Brazil, and Gabon:

- South Africa accounts for ~30% of annual global mined production from open pit and underground mining operations.

- The bulk of the world’s Mn alloy is produced in China and India:

- China imports high-quality Mn to blend with the domestic material; and

- India relies on imported Mn ore feedstock to augment constrained domestic ore sources.

- Mn ore is not exchange traded, and prices are largely determined by supply and demand dynamics linked to the global steel industry production levels:

- More than 90% of Mn ore is consumed in the steel making process.

- Mn ore is priced in USD per dry metric tonne unit (USD/dmtu), and consequently, ore grade is directly reflected in the price per tonne of ore.

Key Applications of Mn Ore

1. Miners

Manganese Ore

2. Intermediate

Manganese Alloy

Electrolytic Manganese

85% Manganese Alloy

27%

High Carbon FeMn

End Users:

Mostly flat steel

- Household durables

- Heavy machinery

49.5%

SiMn

End Users:

Mostly long steel

- Construction

- Infrastructure

13.5%

Medium and Low Carbon FeMn

End Users:

Specialty steel

- Stainless steel

- Strength alloy steel

10%

Other

15% Electrolytic Manganese

83%

EMM

End Users:

Stainless steel

- 200 Series stainless

17%

SiMn

End Users:

Chemicals / Batteries

- Fertilizers

- Ceramics

- Glass

“Mn has been used for many years in primary (non-rechargeable) batteries; mainly dry cell Zinc batteries and more recently Alkaline batteries.”

Manganese in the Battery Value Chain

NMC Proliferation

Source: Benchmark mineral intelligence; Battery university, Joule (October 11, 2017), Euro Manganese Inc.

Overview Manganese

Battery Value Chain

Developments in Mn Applications

- ~90% of Mn is used in producing stainless steel and various alloys, and on route more than 85% of Mn ore is fabricated into Ferro-Manganese and silicon-Manganese (while some special alloys require using high purity Mn metal).

- Mn is also used in Aluminium alloys.

- Other applications have been mainly chemical or specialty in nature, including unleaded gasoline additive, reagent, oxidation element, colouring pigments as well as in soil and nutritional supplements.

- Mn has been used for many years in primary (non-rechargeable) batteries; mainly dry cell Zinc batteries and more recently Alkaline batteries.

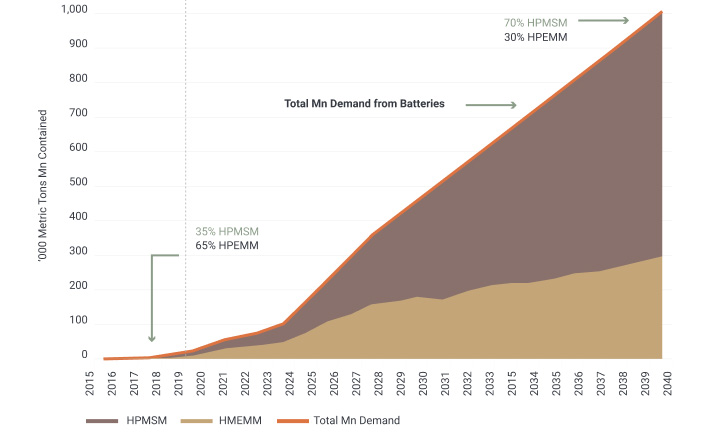

- Recently, Mn has become a critical component in high nickel-containing rechargeable batteries, specifically Nickel Manganese Cobalt (‘NMC’) batteries used in EVs as well as stationary energy storage systems.

- Mn is blended into the cathode precursor as High Purity Manganese Sulphate Monohydrate (‘HPMSM’).

NMC – Why Mn?

- EV batteries based on NMC cathode chemistry – in various proportions of the three materials – are quickly becoming the power unit of choice for most EVs, and by 2028 their share will be 70%.

- NMC, and specifically the high Nickel NMCs, enable higher energy density, leading to longer range between charges, as well as shorter charging time and longer life (more charge cycles before degradation).

- Nickel has a high energy density but poor stability. Mn forms a spinel structure increasing the strength and stability of the battery, yet with low internal resistance.

Mn48 ore is perfect for battery Mn – HPMSM and HPEMM1

- HPMSM, generally having a 32% Mn content, is a crystalline salt with

very low impurity content used to produce high-quality lithium-ion

batteries based on NMC cathode chemistry. - HPMSM can be produced indirectly by dissolving EMM or directly

from (some) Mn ores.- Most battery makers prefer to buy HPMSM that meets their specifications, but 35% procure EMM and make their own HPMSM.

- Mn48 Mn ore is known as “Wessels-type” ore, which has been used for decades in producing EMM due to its favourable morphology and mineralogy and high Mn content.

- Mn48 commissioned a lab in Canada that has more than 30 years of experience in mineral processing, including physical separations and hydrometallurgy, to test its ore.

- Tests confirmed the ore leaches extremely well using acid-sucrose lactate with no need for calcining, impurities bleed away and the Mn is extractable from the pregnant leach solution at near-perfect recoveries.

- Based on the tests, the extract could go for electro-winning (EW) to make EMM or could go through more hydrometallurgical steps to make HPMSM, or both, providing ideal commercial and technical optionality.

Mn48 with its high-grade manganese is well-positioned to benefit from the increased demand from batteries.

1. High-Purity Electrolytic Manganese Metal

Lithium Ion Battery to Electric Vehicle Supply Chain

-

1

Mining

-

2

Chemical Processing

-

3

Cathode Production

-

4

Cell Manufacturing

-

5

Application

Stage One: Mining

|

|

|

|

| Nickel | 8% | 0% | 31% |

| Cobolt | 0% | 0% | 1% |

| Graphite1 | 1% | 0% | 65% |

| Lithium | 0% | 1% | 0% |

| Manganese | 0% | 0% | 6% |

Stage Two: Chemical Processing / Refining

|

|

|

|

| Nickel | 13% | 1% | 65% |

| Cobolt | 17% | 0% | 82% |

| Graphite1 | 0% | 0% | 100% |

| Lithium | 0% | 4% | 59% |

| Manganese | 7% | 0% | 93% |

Stage Three: Cathode or Anode Production

|

|

|

|

| Cathode | 0% | 0% | 61% |

| Anode1 | 0% | 0% | 83% |

Stage Four: Lithium Ion Battery Cell Manufacturing

|

|

|

|

| Cells | 6% | 10% | 73% |

1. Flake Graphite Feedstock, All Anode and Synthetic Source: Benchmark Mineral Intelligence